PhilHealth Contribution Calculator

Are you curious about your PhilHealth contributions for 2025? Whether you’re an employee, employer, self-employed, or an Overseas Filipino Worker (OFW), knowing how to compute your health contributions is essential to understanding your deductions and ensuring compliance with PhilHealth regulations.

Tip: Need to calculate your maternity benefit? Try our SSS Maternity Calculator.

Why PhilHealth is Important

PhilHealth is a vital component of the Philippine health care system, designed to provide Filipinos with access to affordable medical services. Members can benefit from inpatient care, outpatient consultations, catastrophic illness packages, and preventive health services. The sustainability of this system relies on contributions from its members, making it important to stay on top of your dues.

Whether you’re starting to pay PhilHealth contributions or simply updating for the new rates in 2025, this guide will help you calculate your deductions and understand your responsibility as a member.

What’s New for 2025?

- Updated Contribution Rate: The PhilHealth contribution rate for 2025 has been set at 5.0% of an employee’s monthly basic salary.

- Minimum and Maximum Salary Brackets:

- Employees with a monthly basic salary below ₱10,000 will pay contributions based on ₱10,000 (₱500 total).

- Employees earning more than ₱90,000 will cap their contributions at ₱90,000 (₱4,500 total).

- Equal Sharing: Employers and employees split contributions equally, with each paying half of the total amount.

How Contributions are Computed

The formula for calculating contributions is straightforward, ensuring transparency in how much goes to PhilHealth each month.

Formula:

Monthly Salary × 5% Contribution Rate = Total Monthly Contribution

This amount is then divided equally between the employer and employee.

Examples of Contribution Calculations

- Monthly Salary of ₱15,000:

- Total Contribution = ₱15,000 × 5% = ₱750

- Employee Share = ₱375; Employer Share = ₱375

- Monthly Salary of ₱50,000:

- Total Contribution = ₱50,000 × 5% = ₱2,500

- Employee Share = ₱1,250; Employer Share = ₱1,250

- Monthly Salary of ₱90,000 (Maximum Bracket):

- Total Contribution = ₱90,000 × 5% = ₱4,500

- Employee Share = ₱2,250; Employer Share = ₱2,250

If you’re self-employed or an OFW, you’re responsible for paying the full contribution yourself, based on your declared income.

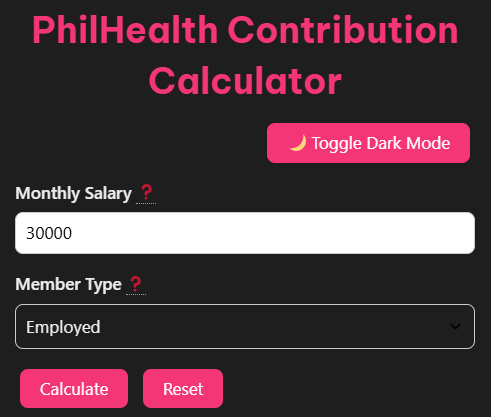

Introducing Our Free PhilHealth Contribution Calculator

To simplify your calculations, our Contribution Calculator has been updated to reflect the latest 2025 PhilHealth contribution rates.

Key Features of the Calculator

- Real-time Results: Calculates contributions instantly based on your input.

- Customizable Inputs: Adjust for varying salaries and employment types, including OFWs and self-employed individuals.

- Employee and Employer Shares: Provides a clear breakdown for both shares.

- Free and Accessible: No subscriptions or hidden fees.

How to Use the Calculator

Follow these simple steps to compute contributions accurately using the free online tool: .

- Input your monthly salary in the designated field.

- For employed individuals, select “employed” as your membership type. If self-employed or an OFW, choose the corresponding option.

- Click the “Calculate” button to view the total contribution along with employee and employer shares.

- Review the detailed breakdown to understand your deductions.

This calculator is a quick and efficient way to ensure you’re paying the correct contributions, saving you time in manual calculations.

Benefits of Using the Calculator

- Accurate Calculations: Stay precise with updated rates and avoid compliance issues.

- User-Friendly Experience: Designed for everyone, whether you’re an HR professional or an individual contributor.

- Time-Saving: Compute contributions in seconds.

- Free Access: Enjoy unlimited use at no cost.

Other Guidelines for OFWs and Self-Employed Individuals

For individuals not employed in a formal sector, the following considerations apply to PhilHealth contributions in 2025:

- OFWs: Contributions are calculated based on the declared monthly income, subject to the 5.0% rate. Payment can be made quarterly, semi-annually, or annually.

- Self-Employed: Similarly, self-employed individuals bear the full contribution and can pay directly at accredited payment channels or through online systems like GCash.

Meeting Payment Deadlines and Avoiding Penalties

Employers are required to remit employee contributions by the 10th of the following month. For self-employed individuals or OFWs, contributions must be made according to the chosen payment schedule. Late remittances can result in penalties, including interest fees and possible legal action.

Always keep a record of your payments to avoid any discrepancies.

Final Thoughts

Understanding your PhilHealth contributions is vital for ensuring access to affordable health care and avoiding penalties for late or incorrect payments. With our PhilHealth Contribution Calculator, calculating your dues has never been easier.

Get started today and ensure you’re contributing just the right amount for 2025.